Strategies to Boost Heat Pump Adoption [Part II]

My recent heat pump installation highlighted key areas needing improvement to reach 100% electric heat by 2050.

This is Part 2 of the series on strategies to boost heat pump adoption. See here for Part 1.

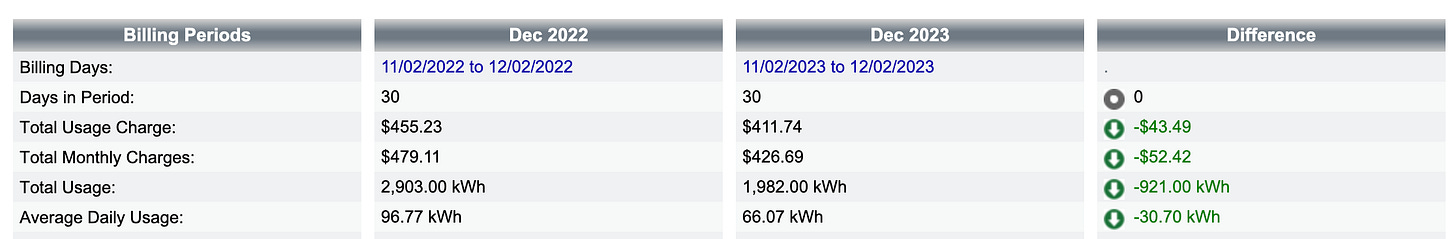

As the crisp fall turns increasingly wintery in December here in New England, our newly installed heat pumps have been plugging away — keeping our home comfortably warm while also delivering on the promise of lowering our heating bill. In fact, based on our latest electric bill, we saved ~$80 in heating costs last month (woot!). So how do we get more heat pumps installed, delivering these benefits to more people while also supporting our collective goal to completely decarbonize residential heating by 2050?

As discussed in part 1, my personal experience installing heat pumps revealed four key opportunities for accelerating adoption:

Scale up heat pump coaching [covered in part 1]

Steer home retrofits towards air-source heat pumps [covered in part 1]

Get HVAC contractors on-board

Radically streamline financing

In this post, we’ll tackle the need to better engage HVAC contractors and improve heat pump financing instruments, both critical components of getting more heat pumps installed at the breakneck speed required.

3. Get HVAC contractors on-board

Despite all of the recent public investment and startup activity relating to heat pumps, local HVAC contractors remain the real “face” of heating and cooling for a vast majority of consumers. They are the ones who actually sell, design, install, and repair these systems, and hold the direct relationships with homeowners. Without their genuine commitment to heat pump technology, we will continue to lag behind our ambitious deployment goals.

The inconvenient truth is that many HVAC contractors are simply most comfortable and confident in selling legacy fossil-fuel heating systems. It’s what they know (they’ve been doing it for decades), it’s a reliable source of income, and they can execute jobs in a short period of time to retain margins.

In contrast, heat pumps are still relatively new. It’s a materially different and more sophisticated technology — demanding new knowledge & skillsets, more installation precision and comes with additional complexity.

Relatedly, heat pumps upend the standard HVAC sales process, primarily related to supporting customers in navigating available governmental incentives. Because government-sponsored heat pump rebate programs are so complicated, many heat pump HVAC contractors actively assist their clients in participating. In my case, my contractor did the following on our behalf:

Ensured the make/model of heat pump they quoted met the latest efficiency standards to be eligible for both local and federal incentives

Submitted a ‘pre-approval’ application to my local utility to ensure the units they were about to install would be approved for rebates

Handled the actual rebate process, providing all the technical installation details so I could claim the $10k and managed communication with the utility representative until I received my check

This is just one example illustrating the higher perceived and/or real “soft costs” associated with installing heat pumps versus legacy solutions, creating understandable hesitation within the HVAC community.

Simply put, when it comes to heat pumps, HVAC installers need to understand “what’s in it for them?”, and have a realistic path to realizing these benefits. And it must be stated that this argument cannot be rooted in climate concerns. Roughly 80% of contractors are right of center, and pitching heat pumps based on environmental benefits will “shut them down”, according to Nate Adams, a thought leader for engaging HVAC contractors in the electrification transition.

So, what will work in getting more HVAC contractors on board with heat pumps?

Show them the business opportunity.

Provide a transition path.

Make relevant training and knowledge accessible.

Show them the business opportunity

This one is a no-brainer. We need to do a better job making the business case to HVAC contractors that incorporating heat pumps makes financial sense. This can be done through demonstrating the contractor ROI of heat pumps such as:

Addressable market growth — the heat pump market is expected to grow from $67B to $132B by 2031 that provides tailwinds to their business

More profit — How available financial incentives for consumers can help grease the wheels of selling higher-cost systems to more prospects

Increased satisfaction and loyalty — customers that have lower heating bills and need less maintenance with heat pumps tend to be happier

Provide a transition path

Next, as with any major change, a series of smaller steps toward an ultimate goal can be more effective than trying to force an “all-at-once” strategy. Providing contractors with opportunities to build expertise in heat pumps without demanding an immediate abandonment of legacy systems is an avenue worth exploring here.

Nate the house whisperer recently proposed such a stepping stone strategy, by which traditional contractors sell hybrid systems (furnace plus heat pump) on their way to full electrification within a few years:

Year 1:

Contractors start selling hybrids.

They note the heat pump carries more heating load than expected. Works best if they can track runtime with a product like Ecobee thermostats.

Year 2:

Full electrification is much less scary. If they do heat load calcs with blower door and past energy use, they remove almost all the risk. Some systems go in all electric.

Year 3:

Contractors have been getting very positive feedback, they start looking for electrification opportunities, especially in areas with high gas meter fees ($700/year is starting to happen.)

Technical HVAC jargon aside, the point is that such a hybrid approach can help traditional contractors build confidence in eventually going all-in on heat pumps based on their own upskilling and real customer feedback.

While a climate purist may push back on the notion of installing any net-new fossil HVAC fuel systems, I would argue that if over the long term this strategy results in growing the number of contractors who sell heat pumps, this strategy will pay off in time. Relatedly, Adams argues the hybrid model is necessary for many contractors to begin the transition path and wouldn’t otherwise happen.

Make relevant training and knowledge accessible

Finally, we also need to lower the barrier for contractors to level up on how to sell, install, and maintain heat pumps through better training that is widely available.

This must come through investing in bridging tighter connections between HVAC contractors and the public/private institutions with a vested interest in heat pump deployment. Right now, I would argue that there still is a disconnect between these groups, creating a gap in the knowledge and enablement that contractors need to fully embrace heat pump technology.

One recent example of an effort to address this gap was the Heat Pump Summit hosted in the Bay Area last month. It was specifically geared towards connecting HVAC professionals with companies (e.g. SPAN, Quilt) and nonprofits working to advance heat pump deployment.

This type of targeted conference that brings contractors together the broader heat pump ecosystem is critical to equipping them with the knowledge needed to integrate heat pumps into their operating model.

4. Radically streamline financing

In addition to bringing more contractors along, we urgently need to improve the heat pump purchasing process for consumers. One of the key differences in the sales process of a heat pump vs. a traditional furnace or boiler is cost. Heat pumps come with a higher price tag than legacy solutions, which continues to hamstring deployment. For many, the up-front cost is still too high, and the available programs to help offset this ‘green premium’ are too cumbersome to navigate.

There generally are two approaches to shrink the cost burden of heat pumps for consumers, each suffering from their own challenges:

Government incentives that reduce up-front costs of heat pumps through rebates and/or tax credits

Key challenge: Delay between time of purchase and customer receiving rebate(s)

Low(er) cost loans that allows paying off the heat pump over time, combined with deferred and/or reduced interest rates

Key challenge: Sharply increased interest rates makes borrowing much more expensive and less financially sensible

Speeding up delivery of government incentives

While there’s no doubt that widely available government rebates and tax credits are helpful in reducing the up-front cost of a heat pump, the delay between the purchase and delivery of the incentives is problematic.

For most government incentive programs, the buyer has to wait weeks or months from when they buy the heat pump and when they get their promised money back. What this means in practice is homeowners still have to shell out the full system price at the point of purchase while they wait for their rebates.

As a specific example, I’m lucky enough to live in a town where a $10k rebate is offered for whole-home heat pump installs on top of federal tax credits. In my case, it took almost 3 months between waiting for my rebate application to be approved by the town and the 4-6 week waiting period for actually getting my check in the mail. Similarly, to receive the $2,000 federal tax credit, I’ll have to wait until mid-April of next year (8 months post-install) when our 2023 taxes are filed. For many, fronting this extra cost, albeit temporary, is not financially feasible and will push them away from moving forward with a heat pump.

While this type of delay between purchase and incentive delivery is not unique to heat pumps (it largely works the same way for other climate-friendly purchases like EVs), the more we can move receipt of these rebates to the point-of-purchase, the more effective these programs will be. This is why I’m excited about a startup called Coral, which offers contractors a way to provide their customers instant heat pump rebate discounts at point-of-sale without having to wait for months to receive rebate funds. With this approach, the homeowner pays only what the system costs net eligible rebates when they buy.

Coral reimburses the contractor with the full rebate amount when they close a heat pump deal minus a small fee for their service. Not only does this model help the buyer in immediately lowering up-front cost, it also can be seen as a useful tool in helping get more HVAC contractors on-board with heat pumps. Coral pitches HVAC contractors on the idea that providing these point-of-sale rebates will help them close more business that otherwise would be lost. The platform also promises to streamline rebate filing and eligibility determination, which otherwise can be a headache for contractors to deal with. Clever financial engineering like this may just be the key to fully unlocking the promise of government incentive programs for heat pumps.

Alleviating borrowing costs in a high interest rate environment

The problem isn’t just the time-delay of getting rebates. We know that electrification purchases like heat pumps currently come with a higher price tag but cost less over time. As such, it stands to reason that a buy now, pay later approach can, in the words of Saul Griffith in his book Electrify “[borrow money to] make our climate dreams come true by creating the confidence that we’ll save money in the future that repays the debt.”

In other words, at the right interest rate, the go-forward savings of a heat pump could come close to or exceed a monthly loan payment and make the purchase much more financially attractive. However, the operative phrase in that sentence is the right interest rate. As we all now acutely feel as consumers, interest rates have sharply risen. The cost of borrowing for anything - be it financing a home, a car, or a heat pump - has roughly tripled.

Now, in many cases, the math just doesn’t add up when comparing the cost of traditional retail borrowing against the monthly savings of switching to a high-efficiency heat pump. Home Equity Lines of Credit (HELOC), a historically useful instrument for financing home upgrades, have gone from ~3-4% in 2019 to just over 10% in December 2023. This makes these loans much less desirable as a financing option as there are no adjustments for climate-friendly purchases like heat pumps.

There are so-called “deferred interest” climate loan providers like GreenSky do offer temporary 0% interest for 12 months. In fact, My HVAC contractor offered GreenSky financing to me during our final negotiations. However, the rate jumps to as high as 25% after the promotional period. This is effectively the same as purchasing using a credit card and paying the minimum balance each month. At best, I’d call this model ineffective and at worst, predatory — especially considering the many reports of shady practices from GreenSky from its customers.

Instead, we need more government-backed, utility sponsored programs that provide zero (or near-zero) interest loans for heat pumps. In the face of an elevated interest rate environment, these types of subsidized loans are especially important to continue encouraging residents to make the climate-friendly HVAC choice.

While states like California, New York, and Maine have programs like this, the best example I’ve found is Mass Save’s HEAT Loan program in Massachusetts. Whereas other states offer reduced interest rates (anywhere between 3-6%) for heat pumps, the HEAT loan offers zero percent interest loans up to $50k for installation of heat pumps. Taking the interest rate to zero goes a long way in making the kitchen table economic argument to go with a heat pump rather than a furnace air tight. The program, sponsored by the big utilities in the state, is funded through a small charge on the energy bills of consumers in Massachusetts. Mass Save is a great example of how government policy, energy providers, and consumers can be aligned towards a collective climate goal. We need to make these types of programs available in more states, and scale them to as many residents as possible.

The challenging road ahead

If we are to reach 100% electric heating by 2050, we’ll need to retrofit 140 million homes in the U.S. by 2035. That’s quite a tall order, as illustrated by the near-vertical heat pump sales curve needed to achieve this goal:

This will truly take a village to get done. Based on my experience of installing a heat pump in 2023, I am skeptical that we currently have the right levers in place to get to where we need to be. However, through scaling heat pump coaching, pointing consumers towards air-source heat pumps, ramping up HVAC contractor enablement, and radically streamlining available financing tools, there’s still a chance we can get this done. Let’s get after it.

Jeff - I live in Los Angeles, heat is needed to be comfortable 68 deg in my house during winter months, but it rarely falls below 50 outside here; the bigger problem is the energy required to run A/C. How do heat pumps differ when it comes to A/C or are they the same ?